How to Download Instant PAN Applied through :-E Filling

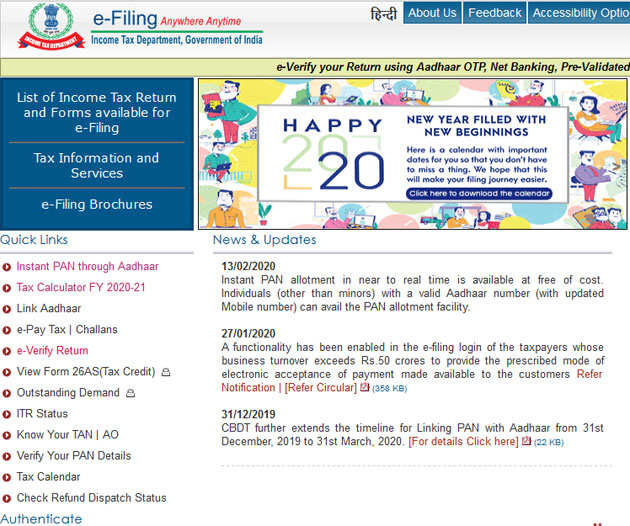

Step 1 : Go to www.incometaxindiaefilling.gov.in

Step 2 : Click on 'Instant PAN through Aadhaar' under the 'Quick Links' section.

Step 3: Click on 'Check Status of PAN/Download PAN'

Step 4 : Submit the Aadhaar number in the required space,an OTP will be sent on your mobile number registered with the UIDAI database.

Step 5 : Enter the OTP in the required space.

Step 6 : Check if the PAN is allotted to you.If it has been allotted to you,then click on the download link to get a copy of the e-PAN.

Is e-PAN/instant PAN valid?

According to the FAQs section on the e-filing website, this PAN is valid. It is not different from the PAN issued by the income tax department via other modes of application. However, this PAN is paperless, online and free of cost.

Further, the e-PAN is a valid proof of PAN. It contains a QR code which contains demographic details of the PAN applicant such as name, date of birth and photograph. These details are accessible through a QR code reader. The e-PAN is duly recognised by Notification No. 7 of 2018 dated December 27, 2018, issued by the Principal Director General of Income-Tax (Systems).

Step 1 : Go to www.incometaxindiaefilling.gov.in

Step 2 : Click on 'Instant PAN through Aadhaar' under the 'Quick Links' section.

Step 3: Click on 'Check Status of PAN/Download PAN'

Step 4 : Submit the Aadhaar number in the required space,an OTP will be sent on your mobile number registered with the UIDAI database.

Step 5 : Enter the OTP in the required space.

Step 6 : Check if the PAN is allotted to you.If it has been allotted to you,then click on the download link to get a copy of the e-PAN.

Is e-PAN/instant PAN valid?

According to the FAQs section on the e-filing website, this PAN is valid. It is not different from the PAN issued by the income tax department via other modes of application. However, this PAN is paperless, online and free of cost.

Further, the e-PAN is a valid proof of PAN. It contains a QR code which contains demographic details of the PAN applicant such as name, date of birth and photograph. These details are accessible through a QR code reader. The e-PAN is duly recognised by Notification No. 7 of 2018 dated December 27, 2018, issued by the Principal Director General of Income-Tax (Systems).

Is e-PAN/instant PAN valid?

According to the FAQs section on the e-filing website, this PAN is valid. It is not different from the PAN issued by the income tax department via other modes of application. However, this PAN is paperless, online and free of cost.

Further, the e-PAN is a valid proof of PAN. It contains a QR code which contains demographic details of the PAN applicant such as name, date of birth and photograph. These details are accessible through a QR c ..

According to the FAQs section on the e-filing website, this PAN is valid. It is not different from the PAN issued by the income tax department via other modes of application. However, this PAN is paperless, online and free of cost.

Further, the e-PAN is a valid proof of PAN. It contains a QR code which contains demographic details of the PAN applicant such as name, date of birth and photograph. These details are accessible through a QR c ..

No comments